Euro Forex Trading Tips

Whether you’re only getting started with the whole Forex thing or already trading, we believe this article will be of much help in your journey.

The following Forex trading tips will give you ideas on how to trade Euro Forex pairs most effectively.

Tip one: Know what you’re after

Trading is, of course, an exciting activity. However engaging it is, the main goal and focus of it is to make your money work. In simpler terms, trading is about earning more.

With that said, when you enter the Forex market, your tactics should be to look for potentially profitable deals while doing your best to avoid losing ones. As straightforward as it gets, this approach still takes time and effort to master.

The ten tips for Forex trading below will show you how to do it.

Tip two: Choose your broker

There are plenty of online financial services providers out there, each offering its own vision of effective trading. While not the only choice, FBS is one of the best picks. With over 550 available instruments and appealing conditions, FBS is a broker that offers up-to-date online trading experience for users in over 150 countries.

Regarding platforms, FBS traders get to trade with one of the world’s most popular ones – MetaTrader 5. The platform is packed with useful features for efficient trading.

Plus, FBS accompanies its traders every step of the way through 24/7 support and, most importantly, a bunch of tools to improve market experience.

Finally, as a respectable broker, FBS regularly provides clients with actual Forex trading tips to help them trade with better results.

Tip three: Follow the news

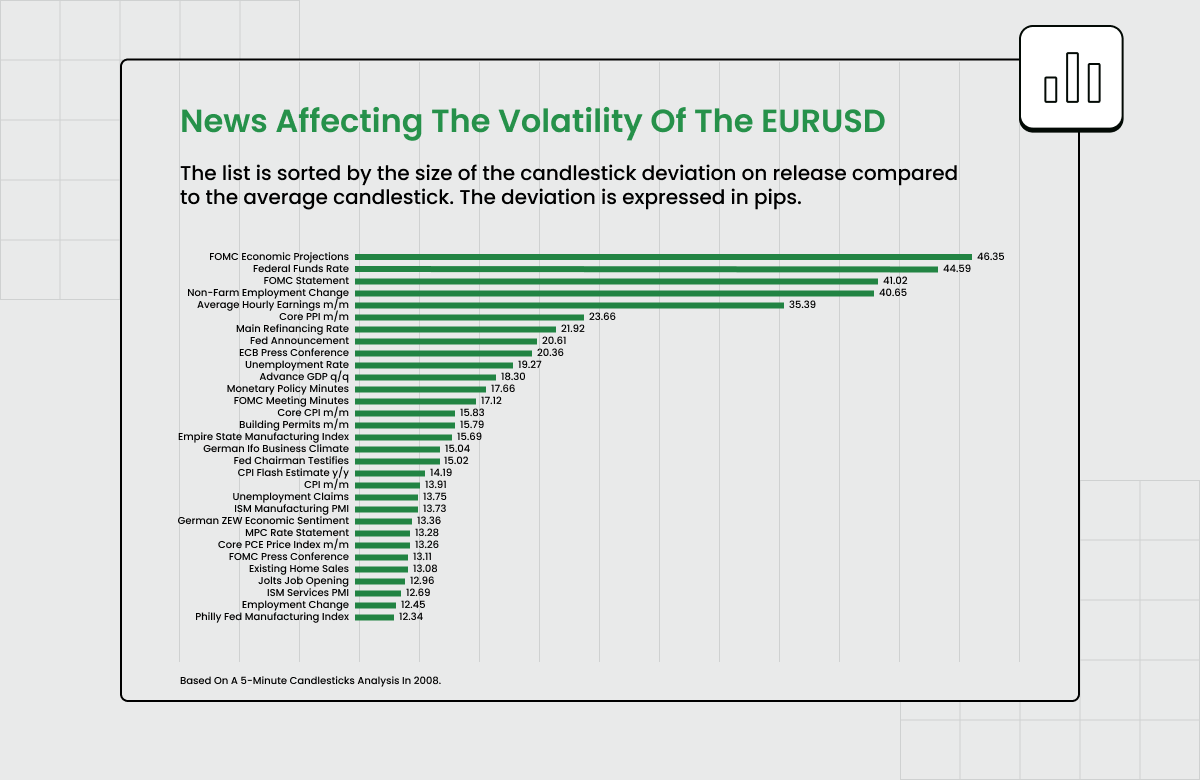

You must know where the market is to trade most effectively. To be aware of what’s happening to Euro-related pairs, like EURUSD, you should use helpful tools your broker provides. One such tool is the economic calendar.

FBS Economic Calendar is a chronicle of key market events that impact the instruments you trade. Events can be highly impactful, drastically changing how a Forex pair behaves.

The graph below shows news releases that impact EURUSD the most. So, keeping an eye on these events is a must if you want to succeed.

Tip four: Check the correlation

Correlation is an essential metric in trading. As you might guess, it indicates how trading instruments are related. The higher the correlation coefficient, the closer they are to each other.

Taking EURUSD as our focus of attention, we can say that it is strongly related to the euro, the dollar index, and gold. If the correlation between the first two is evident and self-explanatory, the correlation between EURUSD and gold may require a detailed explanation.

Since the euro is one of the strongest rival currencies to the US dollar, it is linked to the movements of gold, and the link between the two may, at times, play a positive role for the currency. However, though the euro and gold correlate to the USD negatively, their relationship is far from perfect.

Gold is not only at odds with the USD but also a rival to today's fiat currency-based monetary system. Therefore, the EURUSD may lose or gain in the wake of gold's movements.

Tip five: Stay consistent

The key to effective trading – should we forget about all other Forex tips and tricks - is consistency. It always pays off.

Being a consistent trader is about focusing on one area and sticking to a chosen strategy. If you have prepared well and know what you’re doing, you should be sure about your strategy.

Several options can help you come up with a fruitful strategy. They include:

- Fundamental analysis.

- Technical analysis.

- The combination of both.

- Interest rate arbitrage.

- Sentiment analysis.

- Quantified strategies.

Finally, you cannot be consistent as a trader without having the right mindset. Psychology plays an important role in this. So don't limit yourself with only market-related knowledge – success will also require you to learn more about yourself and how your mind works.

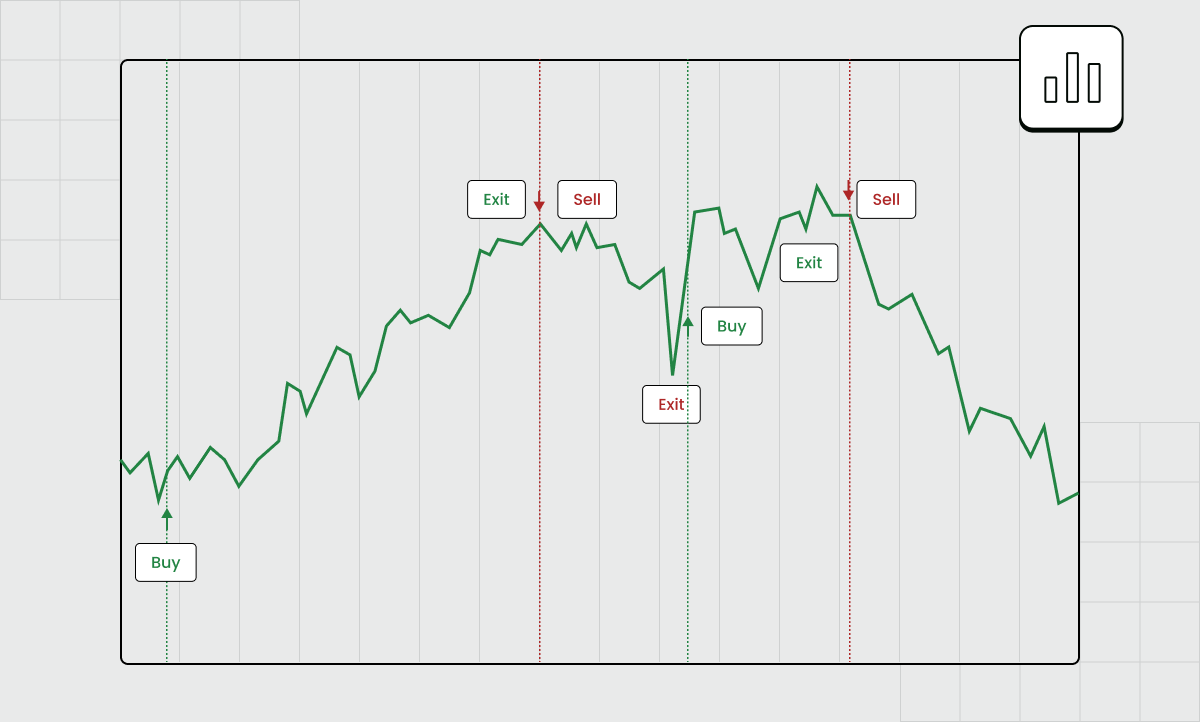

Tip six: Determine entry and exit points

Determining entry and exit points must become your ritual before every trade. You can hardly expect positive results if you just rush into a trade. Unless you are a risky type of trader, you will want more control over potential profit. So, knowing when exactly you open and close a trade is what you should be after.

Regarding risk management, you should also use tools like Stop Loss and Take Profit. The former will help you avoid unnecessary losses by setting a price at which the asset gets sold automatically on its way down. With Take Profit, the asset is sold automatically when it reaches a pre-set price on its way up.

Both Stop Loss and Take Profit let you optimize the trading process without keeping your eyes peeled for open positions.

Tip seven: Calculate expectancy

Another Forex advice that will take your skills up a notch is to assess how you will do in the long run. One trade doesn’t make a difference, so analyzing your trading on one single deal is no use. Instead, try to assess your results every ten trades.

You'll see how helpful it is, as this approach gives you a broader view of the process and helps you calculate income expectations.

However, you can upgrade the whole process by keeping a trader’s journal.

The journal helps you to organize and optimize your trading. As you already know, focus and consistency are key characteristics of a successful trader. Keeping the journal will help you develop and maintain them.

Tip eight: Limit your losses

If you want to make a thoughtful and cautious trader, always set limits to potential losses. This means setting the threshold for how much you can lose without pulling your hair out.

Let's face it: losing is an unfortunate part of trading. But you can learn to avoid losses as much as possible or minimize the damage.

You may think big in terms of potential gains to keep yourself motivated. But it's best to think small when it comes to potential losses.

Tip nine: See what works best for you and why

If a pattern led to a favorable result or some kind of recurring "system" worked well, stick with it. Reward yourself for successful trades - as we all do - but when you do, don't forget to analyze why the trade was so efficient and how exactly you made it work.

This is one of the best tips for Forex trading that will help you build a "tacklebox" of helpful patterns, strategies, and tricks that you can use for future trades.

Tip ten: Do weekly and monthly analysis

Trading is a constant feedback loop. This means you can’t do without regular analysis of your experience and results. Do this every week and every month. This will help you spot your strong and weak points, work on mistakes, and become a better trader.

Use the journal for this. It will help you see where you went right and where you went wrong. You will be able to eliminate counterproductive strategies and failing assets. You don't need things that don't work - use the journal to spot them and cut them out of the process.

Wrap-up

Trading EURUSD is challenging. However, there are ways to master this skill. It will take time and effort, but eventually, it will pay off.

Start exploring trading EURUSD with these ten Forex trading tips. Incorporate them into your routine, use them when you practice with a demo account, and stay consistent.

Feel free to check out other articles in the FBS blog to expand your knowledge and find more Forex advice.

FAQ

What are the most profitable forex trading strategies?

The top trading strategies in Forex include the Bali strategy, the Fight the Tiger candlestick strategy, and the Moving Average-based Profit Parabolic strategy. Overall, a successful strategy is based on the following: technical analysis, fundamental analysis, price patterns, etc.

How to trade $100 in forex?

Trading Forex with $100 is not impossible. It may take more time to do market research, find a proper deal, and calculate the required margin and margin level. When you’re all set and have a strategy to go with, you can enter the market even with a $100 deposit.

With FBS, you can enter Forex with as little as $5. This is possible because FBS offers leverage of 1:3000 to make trading more accessible.

How can I trade EURUSD successfully?

Forex experts advise the following set of tips on Forex trading with the best possible results:

- Backtest your strategy.

- Practice with a demo account.

- Pick the tool you feel the most confident with – if it’s fundamental analysis, stick with it; if you think your thing is technical analysis, go technical.

- While keeping up with the news is a good idea, an even better one is trying not to overdose on news reports.

- Make up a clear plan that includes stop loss and take profit.

- Stay off emotions.

- Take it easy on leverage - overusing it won’t do good.

- Track your performance, and don’t be afraid to adjust your plan if necessary.

- Analyze your mistakes.

What is the 5-3-1 rule in Forex?

The 5-3-1 strategy is a set of three rules traders use to develop the best possible Forex plan that matches their style. This strategy is one of the best ways to trade Forex if you’re a beginner, as the sheer number of currency pairs can be too much for you to handle.

In a nutshell, the 5-3-1 strategy boils down to this:

- Five is how many currency pairs you need to learn and trade.

- Three is how many strategies you need to master.

- One is for the number of trades you make each day.