In the early hours of Tuesday, the US Dollar faces challenges in maintaining its strength against major currencies, with the US Dollar Index struggling to surpass the 104.00 mark. Investors are eagerly anticipating the release of key economic data, including January Durable Goods Orders and the Conference Board's Consumer Confidence Index for February. Additionally, the economic calendar includes reports such as the Housing Price Index for December and manufacturing indexes from both the Richmond Fed and Dallas Fed for February. Despite a modest recovery in the benchmark 10-year US Treasury bond yield from Monday's losses, it remains just below 4.3%. US stock index futures are trading slightly lower following minor losses in major equity indexes on Monday. Forecasts indicate a potential 4.8% decline in Durable Goods Orders for January, following no change in December. Later in the day, Federal Reserve Vice Chair for Supervision Michael Barr is scheduled to address the risks associated with counterfeit credit in a speech.

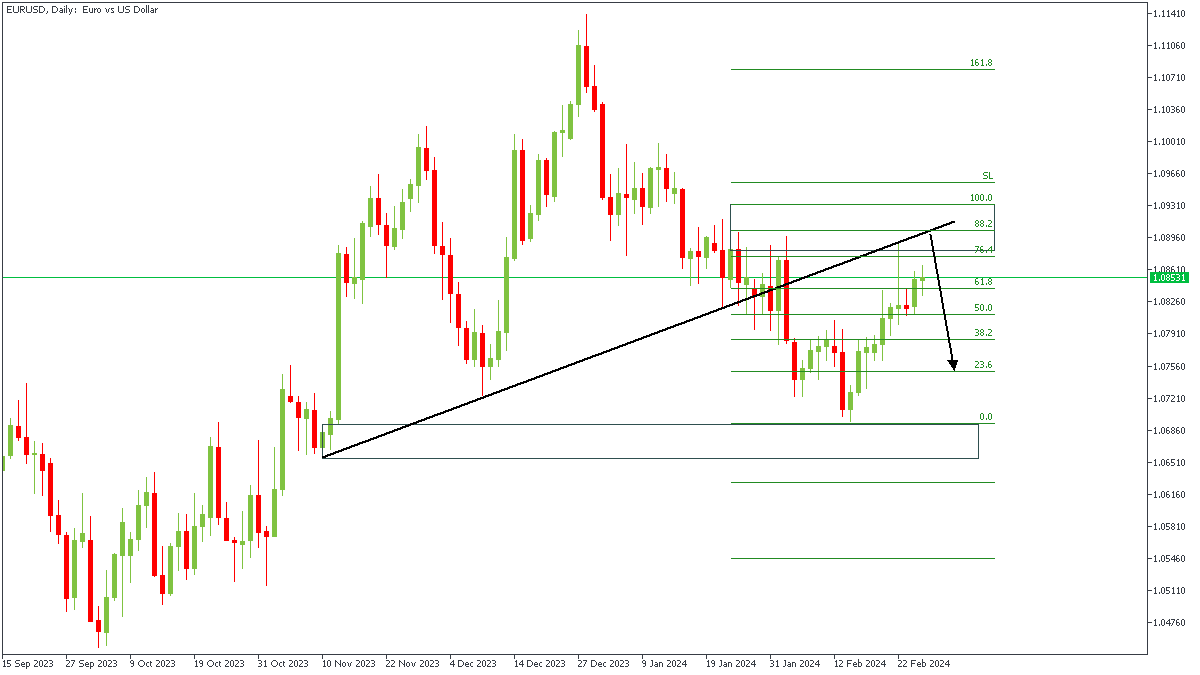

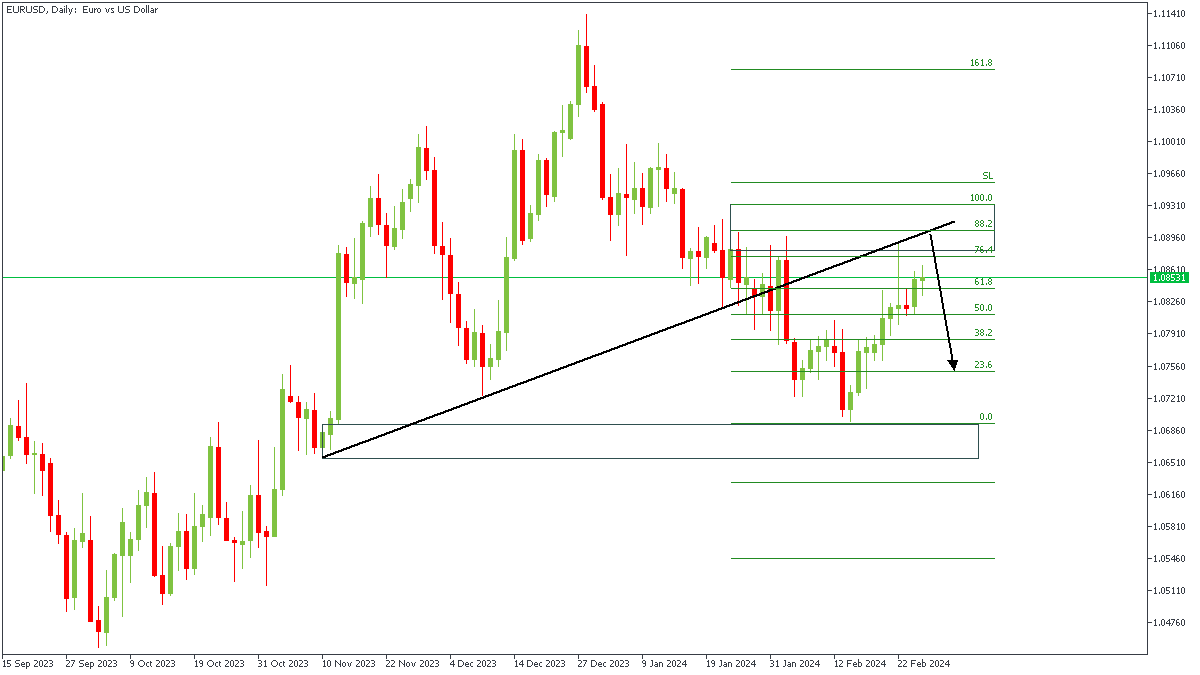

EURUSD - D1 Timeframe

The daily timeframe chart of EURUSD shows price retracing after breaking below the previous low and the trendline support. The current price action is approaching the supply zone at the 88% of the Fibonacci retracement. The confluence of a trendline resistance along with the supply zone and the Fibonacci level provides a strong confirmation for a likely sell entry.

Analyst’s Expectations:

Direction: Bearish

Target: 1.07516

Invalidation: 1.09355

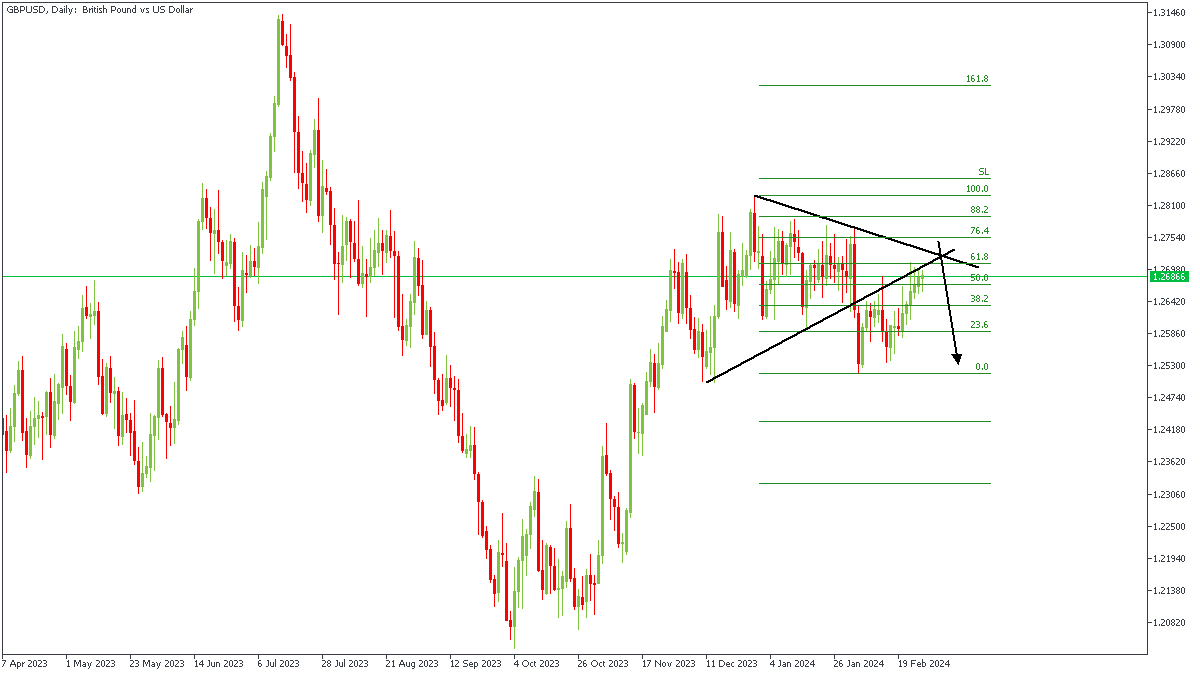

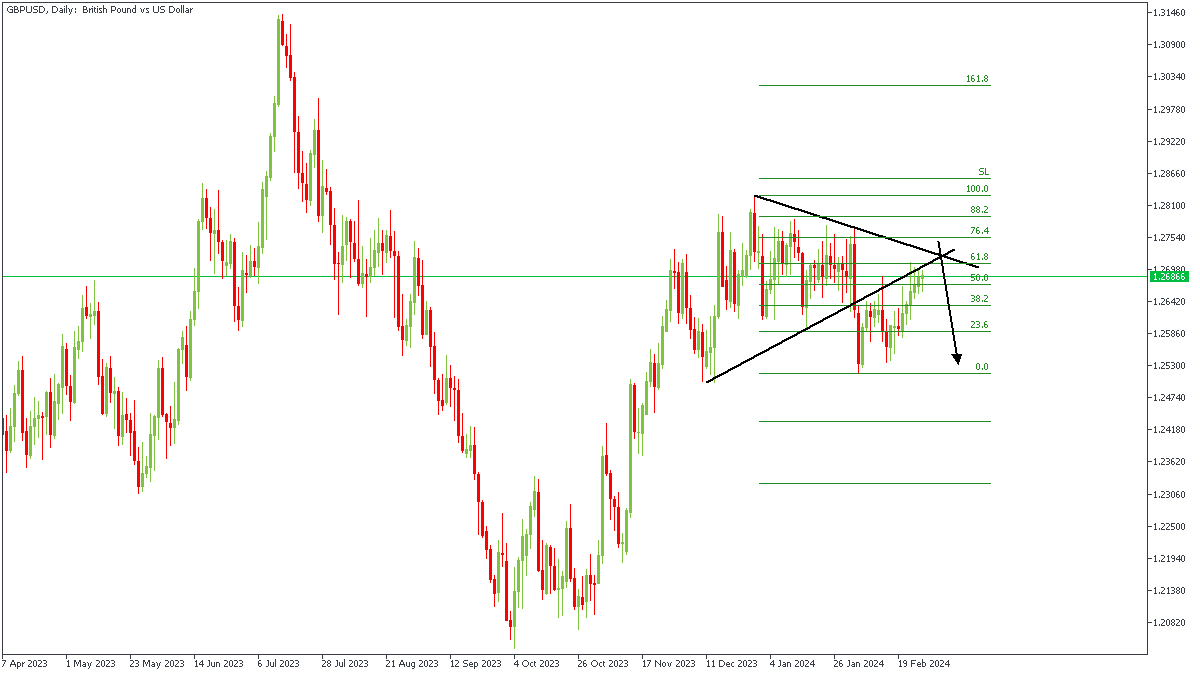

GBPUSD - D1 Timeframe

GBPUSD is currently approaching a confluence of resistance trendlines, along with the pivot zone and the 76% of the Fibonacci retracement. Based on these confluences, I expect to see prices slide towards 1.24900.

Analyst’s Expectations:

Direction: Bearish

Target: 1.25887

Invalidation:1.28341

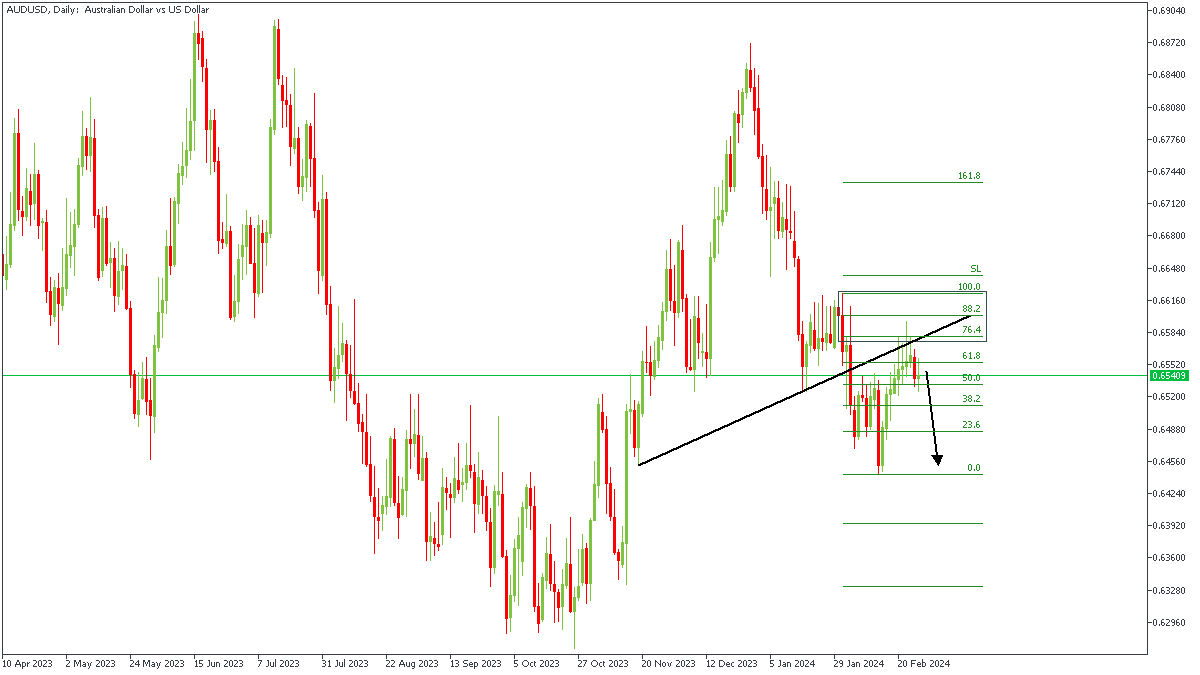

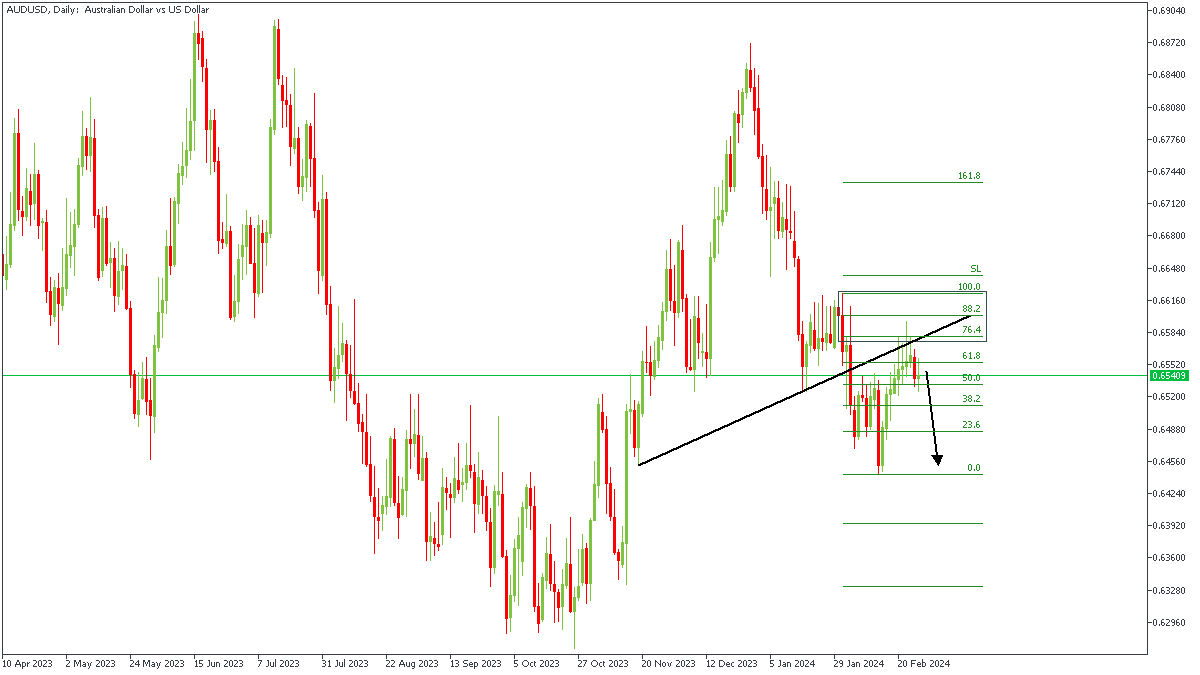

AUDUSD - D1 Timeframe

After breaking the trendline support on the daily timeframe, AUDUSD seems to have completed its retracement, and under bearish pressure from the supply zone and the 76% of the Fibonacci retracement. Considering the confluence of the trendline resistance, supply zone, and the Fibonacci levels, I expect to see prices push lower till the 23% of the Fibonacci retracement.

Analyst’s Expectations:

Direction: Bearish

Target: 0.64867

Invalidation: 0.66260

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.