Bitcoin halving, occurring approximately every four years, is a significant event that halves the reward for Bitcoin mining. This process, ingrained in Bitcoin's algorithm, serves to maintain scarcity and counter inflationary pressures. With each halving, the rate of Bitcoin issuance slows down, potentially leading to price appreciation if demand remains constant. The upcoming halving is expected around May 2024, approximately four years after the previous one. While halving events typically introduce increased price volatility, they are generally viewed as bullish for Bitcoin in the long term due to heightened scarcity. However, investors should exercise caution as reduced mining activity post-halving could impact price stability. Ultimately, to answer the question regarding BTCUSD being overpriced, I believe assessing the growth trajectory of the Bitcoin network is crucial in understanding its potential as a global store of value.

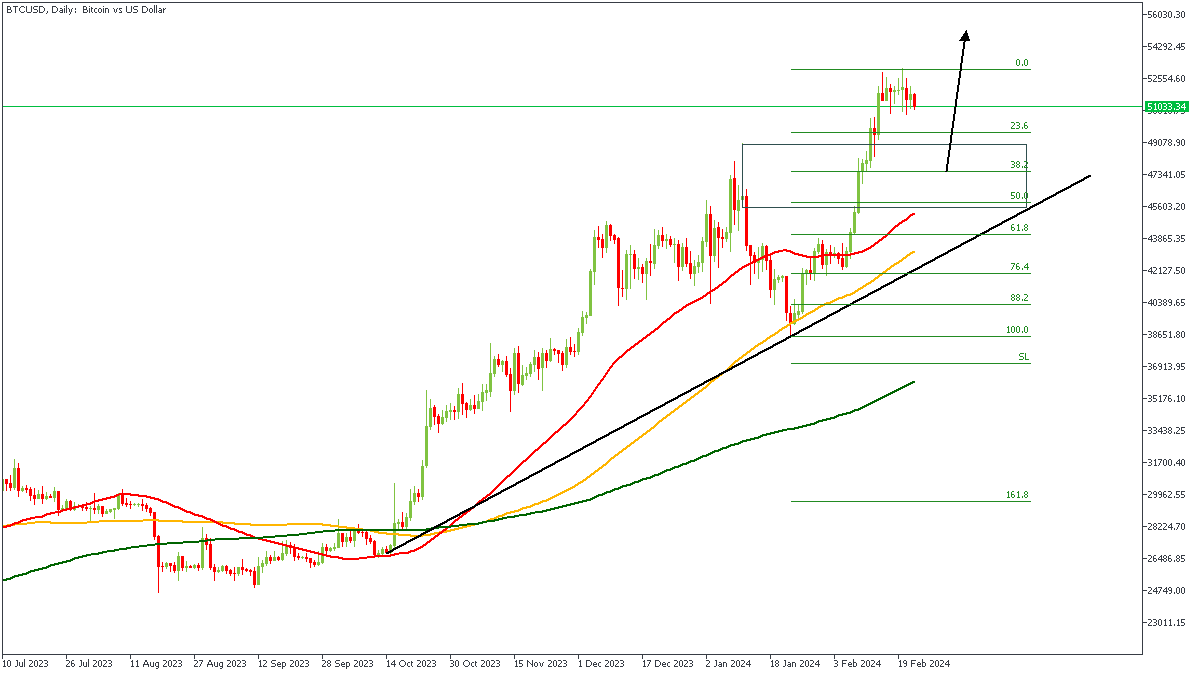

BTCUSD - D1 Timeframe

Bitcoin (BTCUSD) on the daily timeframe recently broke above its previous high at $49k, to hit the $53k mark before entering a consolidation range. This consolidation is likely to be the onset of a retracement move which could see Bitcoin prices drop as low as the $50k mark in a short while. The trendline support, turncoat supply zone, Fibonacci level and the 50-day moving average are my confluences for this sentiment.

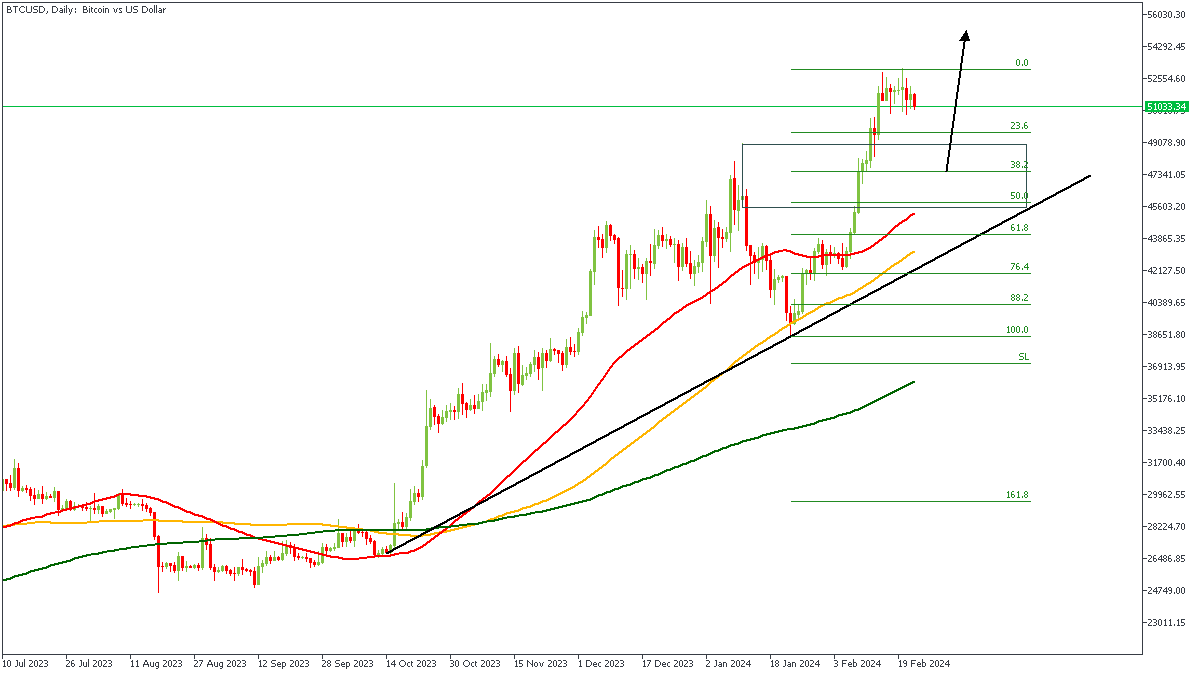

BTCUSD - H4 Timeframe

Here on the 4-hour timeframe of BTCUSD we can see price currently approaching the demand zone from the recent break of structure. The 100-period moving average is also within the reach of the price action, leading me to believe the possibility of a resumption in the bullish trend anytime soon.

Analyst’s Expectations:

Direction: Bullish

Target: $54,500

Invalidation: $47,000

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.