The year started only a couple of weeks ago, but we already have a lot of fascinating movements in various trading instruments. To help you in trading, we choose several forex pairs that may surprise you and plunge greatly in a short period.

GBP/JPY

Japanese Yen is a haven asset, that’s no doubt. As a result, the currency strengthened amid omicron spread as investors have been trying to locate their funds in the most stable currencies, usually the Yen and Swiss Frank. As a result, the currency gained almost 2000 points against the GBP over the last week, but now we see bearish figures both technically and fundamentally.

From the fundamental side, Japan has around 0.5% inflation rate. It is much higher than a year ago (Japan is one of the countries with deflation, which means that the Yen tends to become more expensive with time). Nevertheless, 0.5% in Japan is hard to compare with almost 7% in the US or 5% in the EU. As a result, the Bank of Japan will likely keep its dovish tones. Add this to hawkish tones from other countries’ central banks, and you will get the idea. Fundamentally, without rates hikes, JPY looks weaker against other currencies.

Technically we have an unfinished inversed head&shoulders pattern in GBP/JPY. It is a reversal pattern. Thus, we expect the GBP to rise against the Yen and reach 157.7 in the short term.

GBP/JPY H1 chart

Resistance: 156.70; 157.70

Support: 156.00; 155.50; 155.00

GBP/USD

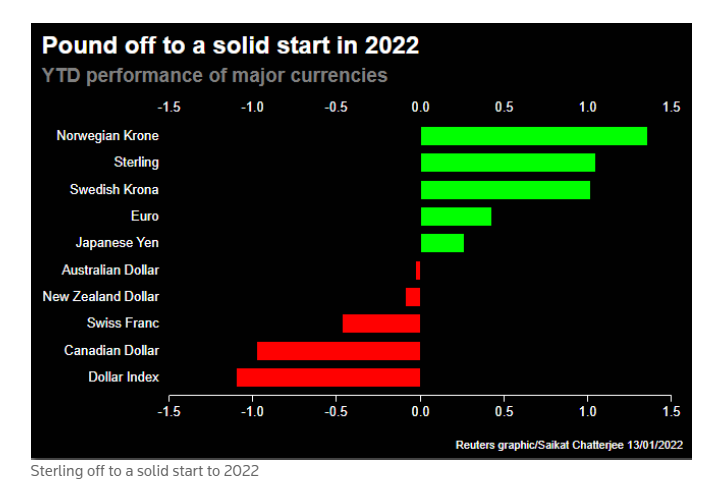

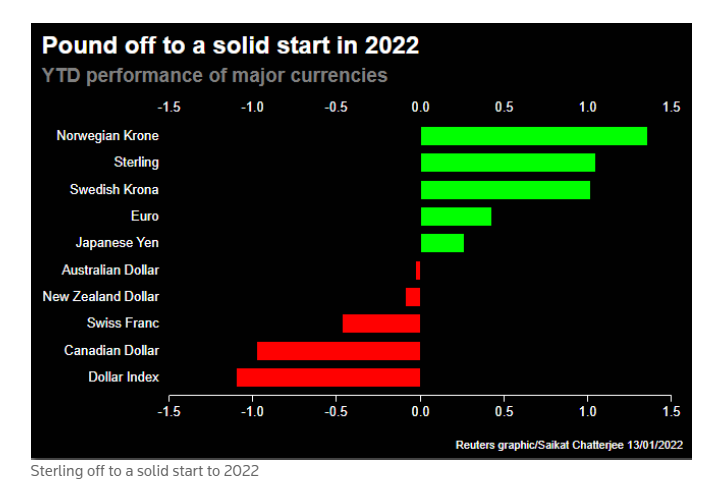

Not only is the Yen weak, but British Pound is solid this year. The currency shows incredible performance against other currencies year-to-date, and amid the weak dollar, we expect a surge in the GBP/USD.

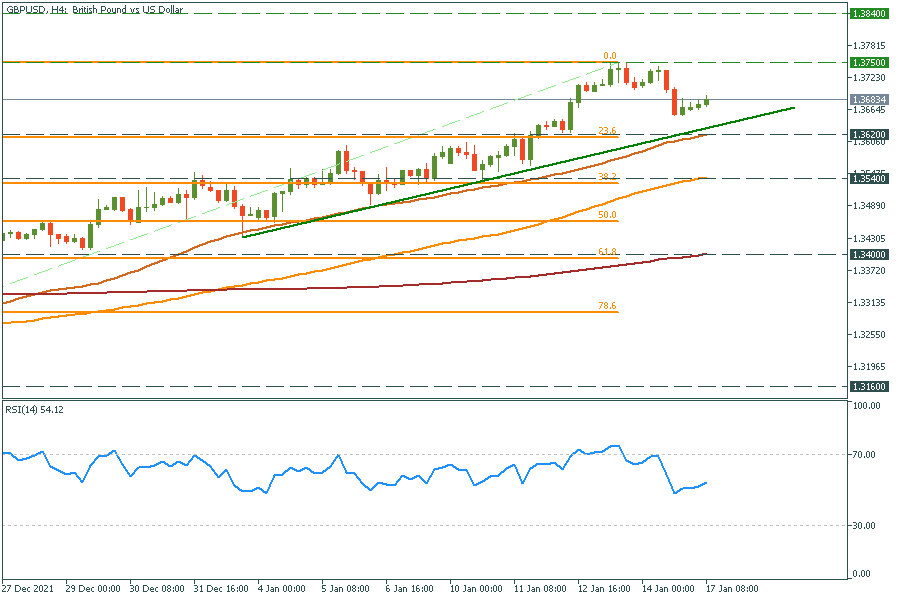

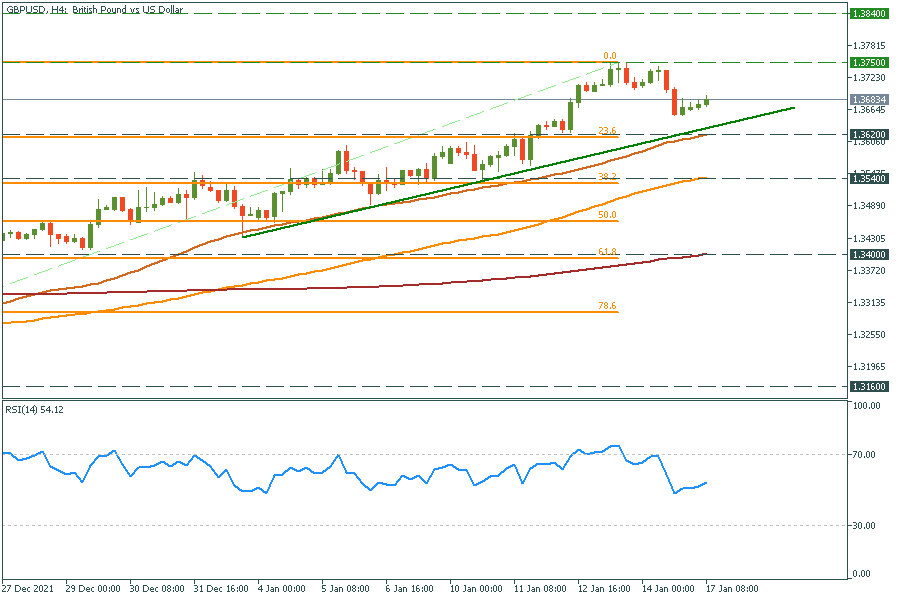

The rally in the pair needs some consolidation. However, technically we have no sell signals except for the RSI divergence. Thus, 1.3620 is a perfect place to put your buy orders.

GBP/USD H4 chart

Resistance: 1.3750; 1.3840

Support: 1.3620; 1.3540; 1.3400; 1.3160

EUR/CHF

First, it is better to wait for ZEW economic sentiment on January 18, 12:00 GMT+2. This index represents the view of institutional investors and analysts on the current economic conditions. Thus, it will help the pair to determine the direction more accurately.

Despite the upcoming news, the Swiss Franc is another haven asset and tends to be weaker amid hawkish tones from the ECB. Technically we see multiple divergences on the RSI and a breakthrough of the 50-daily MA from below. The pair is now at its lowest from 2015. Thus, 1.0330 is the most solid resistance over there. We may see a double bottom reversal pattern and further bullish movement to at least 1.0600.

EUR/CHF daily chart

Resistance: 1.0600; 1.0730

Support: 1.0330

LOG IN